Underwriting Predictor

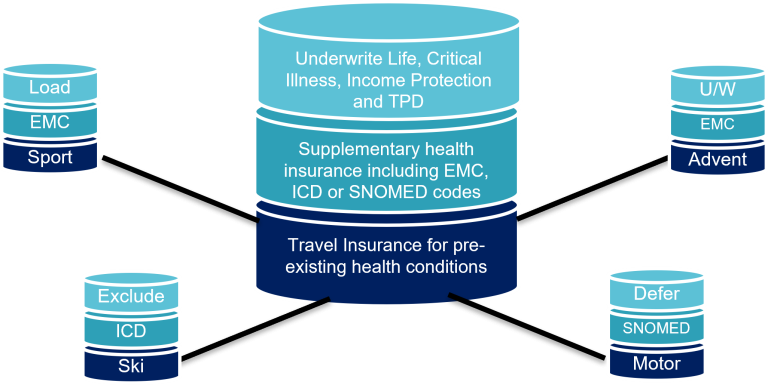

Risk assessment for Life, Critical Illness, Income Protection and TPD Insurance

Do you get asked?

- If I have abnormal blood sugar, can I get insurance? or

- I have high cholesterol, am I eligible for cover? or

- Are my pre-existing health conditions problematic for insurance?

Use Sm8rtHealth to get instant risk assessment outcomes

Qualify your leads

Enhance your needs analysis and duty of care

Help set client expectations

The sizzle...

The Sm8rtHealth risk assessment app will determine specific underwriting outcomes for disclosed medical conditions, BMI, family history, occupations and lifestyle’. Using an elastic search, financial advisers simply type in one or more disclosures, and the tool will provide the corresponding underwriting outcomes.

Resolution and process

- Start an assessment on app.Sm8rtHealth.com

- Enter the Clients name as Reference

- Select the risk assessment required E.g. (Life + CI)

- Copy or send the link for the Client to Complete or Complete on their behalf

The user will input the health factors required (4 screens)

- BMI

- Smoker & Alcohol consumption

- Family History

- Elastic search to identify all pre-existing health conditions.

Once completed, the Adviser will be alerted and can view the underwriting outcomes in the document repository.

A copy of the health inputs provided and the corresponding questions and answers are available with a PDF download

Business Use Case 1

Client request for change in cover terms

Scenario: Longstanding client contacts the Financial Adviser informing them of a need to increase existing cover amount. The Adviser wants to ensure that there is no change to in the client’s health since the in-force policy was written.

Goal: To advise the client of the likelihood of getting the same health cover terms given their increasing age since the policy was first issued.

Business Use Case 2

Fact-check a prospective client

Scenario: An inquiry or lead for some protection insurance is being entertained. In the fact check, you wish to determine the applicant’s health status.

Goal: Determine the likelihood of the application being referred for a manual health review, or an increase in the quotation cost, due to pre-existing medical conditions.

FAQ's

Life, trauma and disability underwriting base rules have been configured in accordance with Re-insurer guidelines for the Asia Pacific region.

Base health rules are region specific and is soon to be available for the NZ and HK regions.

Access is free for 30 days, thereafter the Adviser will need to subscribe for further access. The cost is determined by region, and is set against the base-line of NZ$10.00 per month before any discount or promotion is offered. Billing is done on an annual basis.

The occupation identified is allocated a class identity from 1 to 5 or deferred in some instances. Each carrier will provide a % load or per mil. loading to the occupation class. E.g. Class 1 and 2 are generally considered standard, class 3 could have a 25% load etc. Your historic quotes will guide you as to the load % your provider uses for occupation class.

You can search for these in the elastic search. We have tried to capture all extreme sports and past-times and provided appropriate drill down and questions and underwriting outcomes.

The base rules are configured to take into account co-morbidities and lifestyle choices. By example smoking status will have combination logic for respiratory ailments. Likewise we use inputs such as age and family history in combination with a number of drill-down questions and underwriting outcomes

All we require is you Name, Email, Organisation, and your Country. We do not require credit card details to register.