Smarter Underwriting

Power your growth with a flexible Life and Health insurance SaaS underwriting tool.

Leverage our API-first platform and pre-built rule sets to launch faster, reduce risk, and stay in control.

Now with embedded OpenAI intelligence to accelerate sales, streamline claims, and enhance risk assessment from medical data.

No-code authoring solution

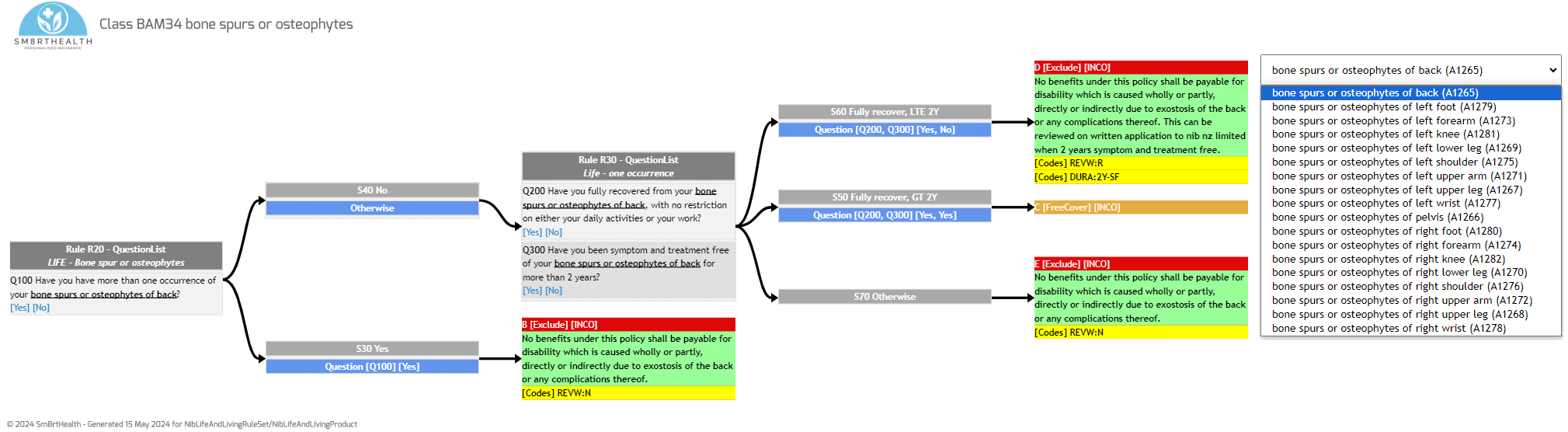

Empower your underwriting team with a no-code rules engine to build and maintain insurance workflows, products, and decision logic effortlessly.

- Reduce implementation cost and time by 75%

- Use OpenAI to integrate into the risk assessment and claims journey

- Pre-configured mortality and morbidity risk assessments covering Life, Critical Illness, Disability and Health

- User friendly workbench

- 100% decisioning

- Applications in minutes, deployment in days

Integrated OpenAI Intelligence

Sales, Claims and Medical Summary Reviews

Voice record, text input or pdf upload to assess insurance risk

Summarise medical data and risk minutes

Automate claims assessment processing

Innovation providing sales growth and cost efficiencies

Conversion Metrics

95%

Medical condition extraction accuracy

75%

Underwriting efficiency gains

100%

Decisioning for Life, CI and Health

> 60%

STP for LIFE benefits